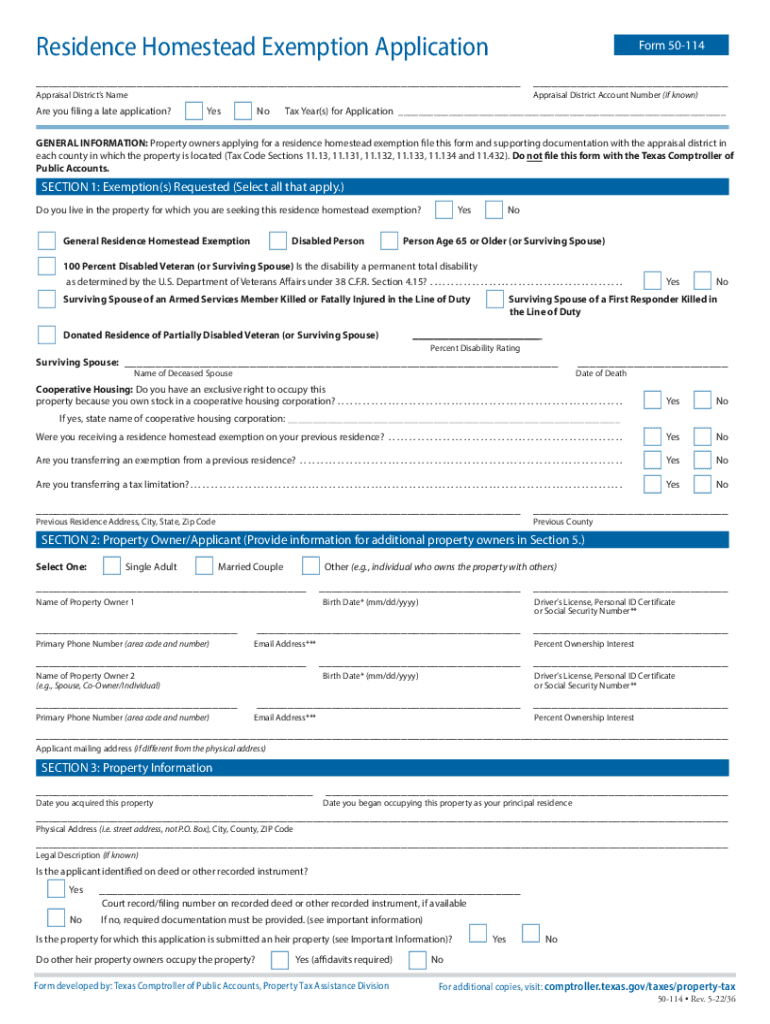

Form 50 114 a "Residence Homestead Exemption Affidavits" Texas 2022

What is the Form 50-114 Residence Homestead Exemption Affidavit in Texas?

The Form 50-114, known as the Residence Homestead Exemption Affidavit, is a legal document used in Texas to apply for a homestead exemption. This exemption can reduce the amount of property taxes owed on a primary residence. By filing this form, homeowners can benefit from tax savings, making it an essential step for those who qualify. The form requires specific information about the property and the homeowner, ensuring that only eligible individuals receive the exemption.

Steps to Complete the Form 50-114 Residence Homestead Exemption Affidavit

Completing the Form 50-114 involves several key steps:

- Gather necessary documents, including proof of identity and property ownership.

- Provide accurate information about the property, including its location and description.

- Fill out the required personal information, such as your name and social security number.

- Sign and date the form to certify that the information provided is true and accurate.

- Submit the form to the appropriate county appraisal district office.

Eligibility Criteria for the Residence Homestead Exemption

To qualify for the homestead exemption in Kendall County, applicants must meet specific criteria:

- The property must be the applicant's primary residence.

- The applicant must own the property as of January first of the tax year.

- The applicant must not claim a homestead exemption on any other property.

Meeting these criteria ensures that the exemption is granted appropriately, allowing homeowners to benefit from reduced property taxes.

Required Documents for Form 50-114 Submission

When submitting the Form 50-114, certain documents are typically required to verify eligibility:

- A copy of the applicant's driver's license or state-issued ID.

- Proof of property ownership, such as a deed or tax statement.

- Any additional documentation that supports the claim for the exemption.

Having these documents ready can streamline the application process and help ensure a successful submission.

Form Submission Methods for the 50-114 Affidavit

The Form 50-114 can be submitted through various methods, providing flexibility for applicants:

- Online submission through the county appraisal district's website, if available.

- Mailing the completed form to the appropriate county office.

- In-person submission at the local appraisal district office.

Choosing the right submission method can depend on personal preference and the resources available in the county.

Legal Use of the Form 50-114 Residence Homestead Exemption Affidavit

The Form 50-114 is legally binding once submitted and accepted by the county appraisal district. It serves as a formal request for a homestead exemption, which can lead to significant tax benefits. Homeowners must ensure that the information provided is accurate and truthful, as any discrepancies could result in penalties or denial of the exemption. Understanding the legal implications of this form is crucial for all applicants.

Quick guide on how to complete form 50 114 a ampquotresidence homestead exemption affidavitsampquot texas

Easily Set Up Form 50 114 A "Residence Homestead Exemption Affidavits" Texas on Any Device

Online document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly and effortlessly. Handle Form 50 114 A "Residence Homestead Exemption Affidavits" Texas on any platform with airSlate SignNow's Android or iOS applications and enhance your document-centric workflow today.

How to Modify and Electronically Sign Form 50 114 A "Residence Homestead Exemption Affidavits" Texas Without Difficulty

- Obtain Form 50 114 A "Residence Homestead Exemption Affidavits" Texas and then click Get Form to commence.

- Utilize the tools we provide to complete your document.

- Emphasize crucial sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Form 50 114 A "Residence Homestead Exemption Affidavits" Texas to ensure outstanding communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 50 114 a ampquotresidence homestead exemption affidavitsampquot texas

Create this form in 5 minutes!

People also ask

-

What is the Kendall County homestead exemption?

The Kendall County homestead exemption is a property tax benefit available to eligible homeowners that reduces the assessed value of their home, thereby lowering property taxes. This exemption is designed to make housing more affordable and accessible for permanent residents in Kendall County.

-

How do I apply for the Kendall County homestead exemption?

To apply for the Kendall County homestead exemption, you need to fill out an application form, which can typically be found on the county's official website. Ensure that you submit your application before the designated deadline to receive the exemption for the upcoming tax year.

-

What are the eligibility requirements for the Kendall County homestead exemption?

To qualify for the Kendall County homestead exemption, you must be the owner of the property, occupy it as your primary residence, and meet certain age or income criteria set by the county. It's important to check the latest guidelines provided by Kendall County to confirm your eligibility.

-

What benefits do I receive from the Kendall County homestead exemption?

The primary benefit of the Kendall County homestead exemption is the reduction in property tax assessments, which can lead to signNow savings annually. Additionally, it helps to ensure a stable community by supporting residents in maintaining their homes.

-

Does the Kendall County homestead exemption affect my mortgage?

The Kendall County homestead exemption does not directly affect your mortgage; however, the reduced property tax burden can ease your monthly financial obligations. Lower property taxes can free up funds that homeowners might allocate towards their mortgage payments or other expenses.

-

Can I still receive the Kendall County homestead exemption if I own multiple properties?

No, the Kendall County homestead exemption is only applicable to your primary residence. If you own multiple properties, you must designate one as your primary home to be eligible for this particular exemption.

-

How does the Kendall County homestead exemption integrate with other tax benefits?

The Kendall County homestead exemption can often be combined with other tax benefits or exemptions, such as those for senior citizens or disabled individuals, to enhance overall savings. Homeowners should consult with a local tax professional to understand how these benefits can work together efficiently.

Get more for Form 50 114 A "Residence Homestead Exemption Affidavits" Texas

Find out other Form 50 114 A "Residence Homestead Exemption Affidavits" Texas

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy